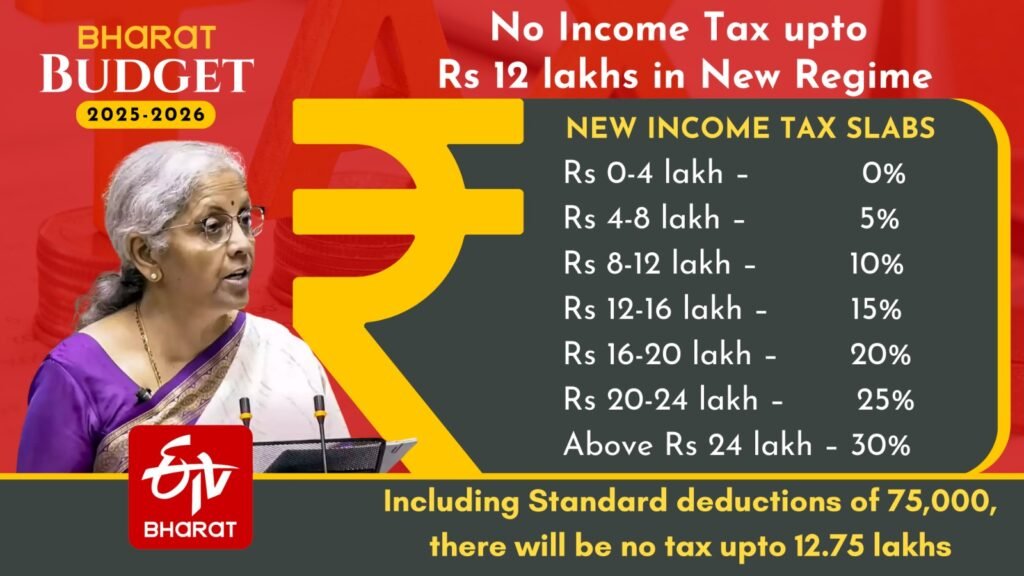

The Indian government has announced that India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh in the 2025 budget by raising the tax-free income limit from ₹5 lakh to ₹12 lakh. This reform is aimed at providing significant relief to the middle class, enabling them to save more and contribute to economic growth. With this change, many individuals will no longer need to pay income tax on earnings up to ₹12 lakh, which is expected to stimulate consumer spending and investment.

This change is expected to benefit millions of salaried individuals, allowing them to have more disposable income. The government’s focus is on boosting domestic consumption and promoting investment, especially in key sectors. By reducing the tax burden on middle-class earners, the government aims to stimulate demand, foster economic growth, and address financial pressures faced by many households in India.

Aggressively, Announcing these 5 reasons

1. Increase in Tax-Free Income Limit

India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh as a major move to reduce the tax burden on middle-class taxpayers. This change means that individuals earning up to ₹12 lakh annually will no longer have to pay income tax, offering relief to millions of salaried professionals and business owners.

The increase in the tax-free limit reflects the government’s intention to provide greater financial freedom to middle-income groups, allowing them to better manage their expenses, invest more in savings, and boost overall economic activity. This reform could potentially reduce the financial pressure on families and encourage them to spend more on goods, services, and investments.

2. Impact on the Middle Class

India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh The middle class in India has often struggled with rising living costs and relatively high tax burdens. With the new tax-free income limit set at ₹12 lakh, millions of taxpayers will benefit from reduced tax liabilities. This is expected to provide much-needed relief to families and professionals in the middle-income bracket.

The anouncement that the India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh then The expanded tax-free limit means that individuals will have more disposable income, which they can utilize for investments, savings, or personal consumption. As a result, we can expect increased spending in the retail, automobile, and housing sectors, which could have a ripple effect on the broader economy. This reform is a step toward addressing the challenges faced by middle-class households, especially in a time of inflation and economic uncertainty.

3. Economic Growth and Investment Boost

India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh, By raising the tax-free income limit, the government is effectively putting more money in the hands of the people. This increased disposable income will likely result in higher consumer spending, which is a key driver of economic growth. More spending means increased demand for goods and services, which in turn stimulates production, job creation, and investments in various sectors.

India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh, The government aims to encourage individuals to spend, invest, and save more, thereby injecting vitality into the domestic market. With more money circulating in the economy, India could see a boost in business activity, improved sales in various industries, and greater financial stability for households. The long-term impact could be substantial as higher consumption leads to higher overall growth and a thriving economy.

4. Government’s Tax Revenue Strategy

India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakhwill undoubtedly reduce direct tax collection from individual taxpayers. However, the government has a well-planned strategy to make up for this potential shortfall. One of the primary ways to balance the revenue loss is by increasing the focus on indirect taxes like Goods and Services Tax (GST). When the announcement of India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh was then people have more disposable income, their spending on goods and services will increase, leading to higher GST collections. This approach ensures that while individuals get tax relief, the government still generates revenue through consumption-based taxes.

Additionally, the government is likely to enhance corporate tax collections by implementing stricter compliance measures.According to the sstatement India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh Many businesses benefit from tax loopholes, and by closing these gaps, the government can ensure that companies contribute fairly to the economy. Increased corporate taxation, along with better monitoring of high-net-worth individuals, could help offset the revenue loss caused by lower personal income tax collections. Moreover, the government might introduce sector-specific levies or additional duties on luxury items to maintain fiscal stability.

India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh, Another significant strategy is the use of technology and artificial intelligence (AI) in tax monitoring and compliance. The government has been increasingly relying on data analytics to detect tax evasion and ensure better compliance among taxpayers. With improved tracking mechanisms, authorities can identify underreported incomes and undisclosed assets, leading to a higher tax collection from businesses and high-income individuals. This digital transformation in tax administration will play a crucial role in maintaining financial stability.

Despite these measures, some experts argue that a reduction in direct tax collections might impact public spending on infrastructure, healthcare, and education. However, the government believes that the overall economic boost from increased consumer spending and investments will compensate for any short-term revenue losses. If more people invest in businesses, real estate, and financial markets, the resulting economic growth will generate additional revenue streams for the government. India Raises Tax-Free Income Limit from ₹5 Lakh to ₹12 Lakh Thus, while this tax reform initially appears to reduce direct tax earnings, the long-term benefits could significantly strengthen India’s economy.

5. Long-Term Financial Impact on India

While this tax reform is beneficial in the short term, experts are debating its long-term impact. Some argue that it may lead to a shortfall in government revenue, affecting public spending on infrastructure and welfare programs. Others believe that the economic growth triggered by higher disposable income will eventually make up for any losses.

The government is optimistic that this change will encourage taxpayers to declare their income honestly and participate in the formal economy. If implemented efficiently, this reform could mark a major shift in India’s taxation policies, making the country more attractive for professionals and businesses.

Get the Best Domain & Hosting for Your Website Today!

Leave a Reply